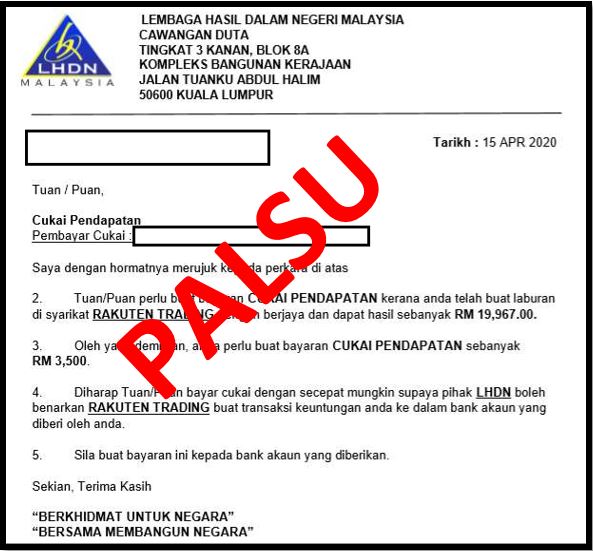

The victims are contacted by the syndicate through messages, phone calls, letters or e-mails regarding their tax arrears payment. They are then lured to transfer the money into the bank account which does not belong to the IRBM.

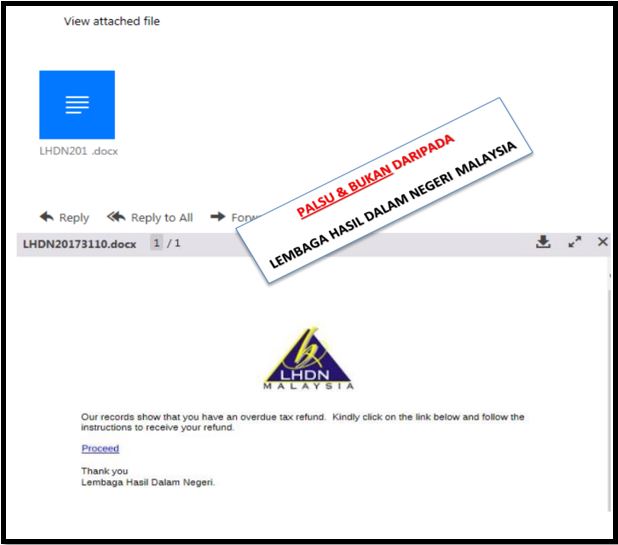

The victims are contacted by the syndicate who claim to be an IRBM officer or a police officer and these victims are ordered to download a fake mobile application of the Central Bank of Malaysia (CBM) or share their personal banking details on the fake website which is claimed to be operated by the CBM for investigation purpose.