| No | Country or Jurisdiction |

Status | DTA | MLI | ||

| Signed Date Entry Into Force (EiF) Entry Into Effect (EiE) |

Order | Entry Into Force (EiF) Entry Into Effect (EiE) |

Synthesised Text (ST) | |||

| 1 | Albania |

In force | Signed : 24 January 1994 EiF : 21 August 1995 EiE :

|

P.U. (A) 340/1994 |

EiF :

|

ST Albania |

| 2 | Australia |

In force | Signed : 20 August 1980 EiF : 26 June 1981 EiE : 1 January 1980 |

P.U. (A) 347/1980 |

EiF :

EiE :

|

ST Australia |

| Signed : 2 August 1999 EiF : 27 June 2000 EiE : 1 January 1988 |

Protocol 1. P.U. (A) 440/1999 |

|||||

| Signed : 28 July 2002 EiF : 23 July 2003 EiE : 1 January 1993 |

Protocol 2. P.U. (A) 162/2003 |

|||||

| 28 July 2002 | Notes Of Exchange | |||||

| Signed : 24 February 2010 EiF : 8 August 2011 EiE : 8 August 2011 |

Protocol 3. P.U. (A) 168/2010 |

|||||

| 3 | Austria |

In force | Signed : 20 September 1989 EiF : 1 December 1990 EiE : 1 January 1988 |

P.U. (A) 426/1989 |

To be updated | |

| 4 | Bahrain |

In force | Signed : 14 June 1999 EiF : 31 July 2000 EiE :

|

P.U. (A) 439/1999 |

To be updated | |

| Signed : 14 October 2010 EiF : 20 February 2012 EiE : 22 March 2012 |

P.U. (A) 162/2011 |

|||||

| 5 | Bangladesh |

In force | Signed : 19 April 1983 EiF : 31 December 1984 EiE : 1 January 1982 |

P.U. (A) 113/1984 |

N/A | N/A |

| 6 | Belgium |

In force | Signed : 24 October 1973 EiF : 14 August 1975 EiE : 1 January 1976 |

P.U. (A) 263/1976 |

To be updated | |

| Signed : 25 July 1979 EiF : 25 July 1979 EiE : 1 January 1976 |

||||||

| 7 | Bosnia and Herzegovina |

In force | Signed : 21 June 2007 EiF : 30 July 2012 EiE :

|

P.U. (A) 341/2007 |

EiF :

|

ST Bosnia and Herzegovina |

| 8 | Brunei |

In force | Signed : 5 August 2009 EiF : 17 June 2010 EiE :

|

P.U. (A) 78/2010 |

N/A | N/A |

| 9 | Cambodia |

In force | Signed : 3 September 2019 EiF : 28 December 2020 EiE : 1 January 2021 |

P.U. (A) 377/2019 |

N/A | N/A |

| 10 | Canada |

In force | Signed : 16 October 1976 EiF : 18 December 1980 EiE : 1 January 1981 |

P.U. (A) 69/1977 |

To be updated | |

| 11 | Chile |

In force | Signed : 3 September 2004 EiF : 25 August 2008 EiE :

|

P.U. (A) 84/2005 |

EiF :

|

ST Chile |

| 12 | China |

In force | Signed : 23 November 1985 EiF : 14 September 1986 EiE : 1 January 1988 |

P.U. (A) 96/1986 |

EiF :

|

ST China |

| Signed : 5 June 2000 EiF : 5 June 2000 EiE : 5 June 2000 |

P.U. (A) 393/2000 |

|||||

| 1 November 2016 | Notes Of Exchange | |||||

| 13 | Croatia |

In force | Signed : 18 February 2002 EiF : 15 July 2004 EiE :

|

P.U. (A) 426/2003 |

EiF :

|

ST Croatia |

| 14 | Czech Republic |

In force | Signed : 8 March 1996 EiF : 31 March 1997 EiE : 1 January 1999 |

P.U. (A) 393/1996 |

N/A | N/A |

| 15 | Denmark |

In force | Signed : 4 December 1970 EiF : 4 June 1971 EiE : 1 January 1968 |

P.U. (A) 86/1971 |

EiF :

Malaysia EiE :

Denmark EiE :

|

ST Denmark |

| Signed : 3 December 2003 EiF : 17 January 2005 EiE : 1 January 2006 |

P.U. (A) 154/2004 |

|||||

Effective DTAs

Limited Agreement

| No | Country | |

| 1 | Argentina |

|

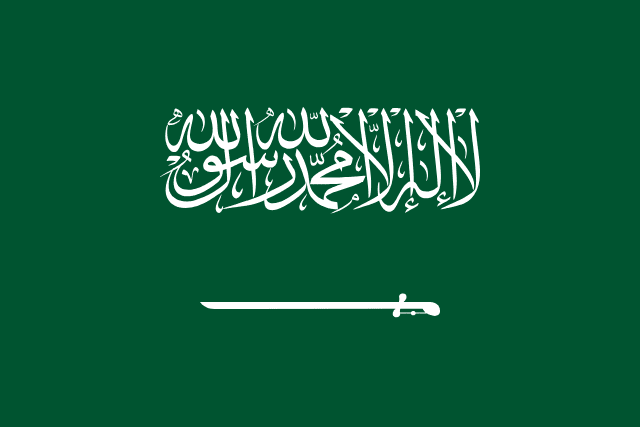

| 2 | Saudi Arabia |  |

| 3 | United States of America |  |

Effective TIEA

| No | Country | |

| 1 | Bermuda |  |

Gazetted DTAs

| No | Country | Date Signed | |

| 1 | Belgium |  |

18 December 2009 |

| 2 | Indonesia |  |

19 July 2012 |

| 3 | Kuwait |  |

26 August 2010 |

| 4 | Senegal |  |

25 May 2010 |

| 5 | Seychelles |  |

26 August 2010 |

DTAs Under Negotiation

| No | Country | |

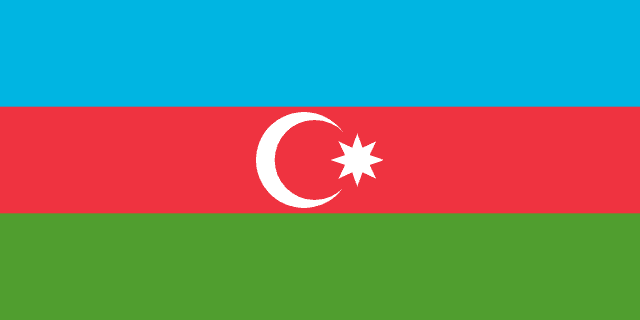

| 1 | Azerbaijan |  |

| 2 | Barbados |  |

| 3 | Belarus |  |

| 4 | Brazil |  |

| 5 | Canada (New Agreement) |  |

| 6 | China (New Agreement) |  |

| 7 | Cyprus |  |

| 8 | Denmark (New Agreement) |  |

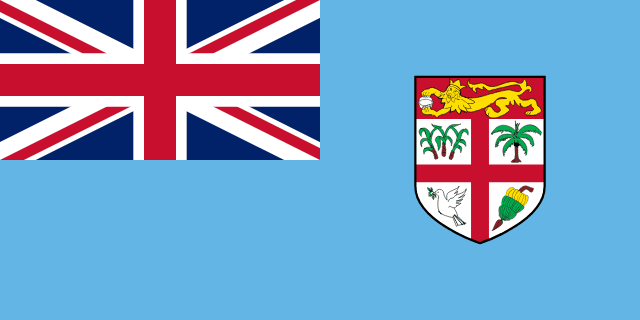

| 9 | Fiji |  |

| 10 | Finland |  |

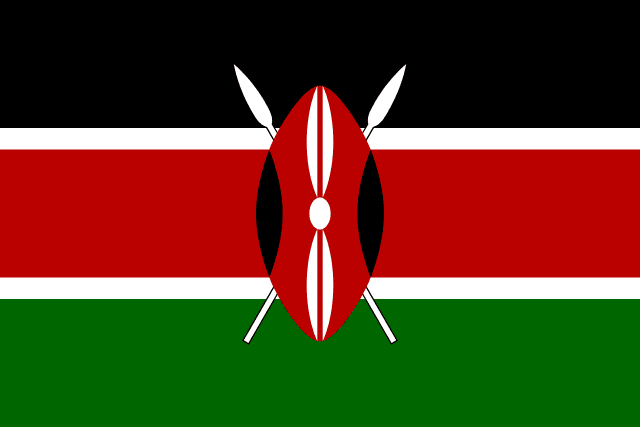

| 11 | Kenya |  |

| 12 | Lesotho |  |

| 13 | Mexico |  |

| 14 | Nepal |  |

| 15 | Norway |  |

| 16 | Oman |  |

| 17 | Portugal |  |

| 18 | Russia (New Agreement) |  |

| 19 | Korea Republic |  |

| 20 | Tajikistan |  |

| 21 | Tunisia |  |

| 23 | Uruguay |  |

| 24 | Yemen |  |

Double Tax Agreements Withholding Tax Rates

Double Tax Agreements Withholding Tax Rates

| EFFECTIVE DOUBLE TAXATION AGREEMENTS | ||||||

| No | Country | Rates (%) | ||||

| Dividends | Interest | Royalties | Technical Fees | |||

| Malaysia Domestic Rate |

|

NIL | 15 | 10 | 10 | |

| 1 | Albania |  |

NIL | 10 | 10 | 10 |

| 2 | Australia |  |

NIL | 15 | 10 | NIL |

| 3 | Austria |  |

NIL | 15 | 10 | 10 |

| 4 | Bahrain |  |

NIL | 5 | 8 | 10 |

| 5 | Bangladesh |  |

NIL | 15 | 10 | 10 |

| 6 | Belgium |  |

NIL | 15/10(iv) | 10 | 10 |

| 7 | Bosnia and Herzegovina |  |

NIL | 10 | 8 | 10 |

| 8 | Brunei |  |

NIL | 10 | 10 | 10 |

| 9 | Cambodia |  |

NIL | 10 | 10 | 10 |

| 10 | Canada |  |

NIL | 15 | 10 | 10 |

| 11 | Chile |  |

NIL | 15 | 10 | 5 |

| 12 | China |  |

NIL | 10 | 10 | 10 |

| 13 | Croatia |  |

NIL | 10 | 10 | 10 |

| 14 | Czech Republic |  |

NIL | 12 | 10 | 10 |

| 15 | Denmark |  |

NIL | 15 | 10 | 10 |

| 16 | Egypt |

|

NIL | 15 | 10 | 10 |

| 17 | Fiji |  |

NIL | 15 | 10 | 10 |

| 18 | Finland |  |

NIL | 15 | 10 | 10 |

| 19 | France |  |

NIL | 15 | 10 | 10 |

| 20 | Germany |  |

NIL | 10 | 7 | 7 |

| 21 | Hong Kong |  |

NIL | 10 | 8 | 5 |

| 22 | Hungary |  |

NIL | 15 | 10 | 10 |

| 23 | India |  |

NIL | 10 | 10 | 10 |

| 24 | Indonesia |  |

NIL | 10 | 10 | 10 |

| 25 | Iran |  |

NIL | 15 | 10 | 10 |

| 26 | Ireland |  |

NIL | 10 | 8 | 10 |

| 27 | Italy |  |

NIL | 15 | 10 | 10 |

| 28 | Japan |  |

NIL | 10 | 10 | 10 |

| 29 | Jordan |  |

NIL | 15 | 10 | 10 |

| 30 | Kazakhstan |  |

NIL | 10 | 10 | 10 |

| 31 | Korea Republic |  |

NIL | 15 | 10 | 10 |

| 32 | Kuwait |  |

NIL | 10 | 10 | 10 |

| 33 | Kyrgyz Republic |  |

NIL | 10 | 10 | 10 |

| 34 | Laos |  |

NIL | 10 | 10 | 10 |

| 35 | Lebanon |  |

NIL | 10 | 8 | 10 |

| 36 | Luxembourg |  |

NIL | 10 | 8 | 8 |

| 37 | Malta |  |

NIL | 15 | 10 | 10 |

| 38 | Mauritius |  |

NIL | 15 | 10 | 10 |

| 39 | Mongolia |  |

NIL | 10 | 10 | 10 |

| 40 | Morocco |  |

NIL | 10 | 10 | 10 |

| 41 | Myanmar |  |

NIL | 10 | 10 | 10 |

| 42 | Namibia |  |

NIL | 10 | 5 | 5 |

| 43 | Netherlands |  |

NIL | 10 | 8 | 8 |

| 44 | New Zealand |  |

NIL | 15 | 10 | 10 |

| 45 | Norway |  |

NIL | 15 | 10 | 10 |

| 46 | Pakistan |  |

NIL | 15 | 10 | 10 |

| 47 | Papua New Guinea |  |

NIL | 15 | 10 | 10 |

| 48 | Philippines |  |

NIL | 15 | 10 | 10 |

| 49 | Poland |  |

NIL | 15 | 10 | 10 |

| 50 | Qatar |  |

NIL | 5 | 8 | 8 |

| 51 | Romania |  |

NIL | 15 | 10 | 10 |

| 52 | Russia |  |

NIL | 15 | 10 | 10 |

| 53 | San Marino |  |

NIL | 10 | 10 | 10 |

| 54 | Saudi Arabia |  |

NIL | 5 | 8 | 8 |

| 55 | Seychelles |  |

NIL | 10 | 10 | 10 |

| 56 | Singapore |  |

NIL | 10 | 8 | 5 |

| 57 | Slovak Republic |  |

NIL | 10 | 10 | 5 |

| 58 | South Africa |  |

NIL | 10 | 5 | 5 |

| 59 | Spain |  |

NIL | 10 | 7 | 5 |

| 60 | Sri Lanka |  |

NIL | 10 | 10 | 10 |

| 61 | Sudan |  |

NIL | 10 | 10 | 10 |

| 62 | Sweden |  |

NIL | 10 | 8 | 8 |

| 63 | Switzerland |  |

NIL | 10 | 10 | 10 |

| 64 | Syria |  |

NIL | 10 | 10 | 10 |

| 65 | Thailand |  |

NIL | 15 | 10 | 10 |

| 66 | Türkiye |  |

NIL | 15 | 10 | 10 |

| 67 | Turkmenistan |  |

NIL | 10 | 10 | NIL |

| 68 | Ukraine |  |

NIL | 10 | 8 | 8 |

| 69 | United Arab Emirates |  |

NIL | 5 | 10 | 10 |

| 70 | United Kingdom |  |

NIL | 10 | 8 | 8 |

| 71 | Uzbekistan |  |

NIL | 10 | 10 | 10 |

| 72 | Venezuela |  |

NIL | 15 | 10 | 10 |

| 73 | Vietnam |  |

NIL | 10 | 10 | 10 |

| 74 | Zimbabwe |  |

NIL | 10 | 10 | 10 |

| (i) The effective tax rate will be either the DTA rates or the Malaysia domestic rate whichever lower. (ii) There is no withholding tax on dividends paid by Malaysia companies. (iii) The payer need to retain Certificate of Tax Residence of the payee issued by the tax authority from the country of residence for audit purposes. (iv) Withholding tax rate of 10% is only applicable for interest payment paid or incurred by an enterprise in an industrial undertaking. |

||||||

| No | Country | Rates (%) | ||||

| Dividends | Interest | Royalties | Technical Fees | |||

| 1 | Argentina |  |

NIL | 15 | 10 | 10 |

| 2 | United States of America |  |

NIL | 15 | 10 | 10 |

| All withholding tax rates on interest, royalties and fees for technical services are as provided under the ITA 1967. | ||||||

| No | Country | Rates (%) | ||||

| Dividends | Interest | Royalties | Technical Fees | |||

| 1 | Chinese Taipei |  |

NIL | 10 | 10 | 7.5 |

Untuk maklumat lanjut, sila hubungi kami di alamat :

Jabatan Percukaian Antarabangsa,

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia,

Menara Hasil, Aras 12, Persiaran Rimba Permai,

Cyber 8, 63000 Cyber Jaya, Selangor,

MALAYSIA .

Telefon : (+603) 8313 8888

Faks : (+603) 8313 7848 / (+603) 8313 7849

e-mel : lhdn_int@hasil.gov.my