Cessation of employment / termination of employment / cessation by reason of death:

-

Where the employer is about to cease to employ an employee:

- who is chargeable to tax in respect of income from the employment; or

- is likely to be chargeable to tax in respect of income from the employment; or

- an employee under his employment dies.

the employer is required to furnish Form CP22A / CP22B not less than 30 days before the cessation of employment or not more than 30 days after being informed of death.

- Form CP22A/ CP22B can be submitted either online or at the IRBM office which handles the employee’s income tax number.From 1 January 2024, Form CP22A / CP22B is mandatory to be submitted online through MyTax portal using e-SPC application.

-

However, employer is not required to furnish such form where the income of an employee has been subject to monthly tax deduction (MTD) or where the employee’s monthly remuneration is below the minimum amount of income that is subject to MTD, provided that the employee will continue working or not retiring from any employment in Malaysia.With effect from 1 December 2023, compliance to the condition in bold is exempted on a concessional basis by KPHDN for employees who resigned / terminated.

-

Subject to exemption under paragraph 3, the employer is required to withhold any monies payable to an employee who has ceased or is about to cease to be employed. The employer shall not pay any such money, except with the permission of the IRBM, to or for the benefit of the employee until 90 days after the receipt by the IRBM of the form.

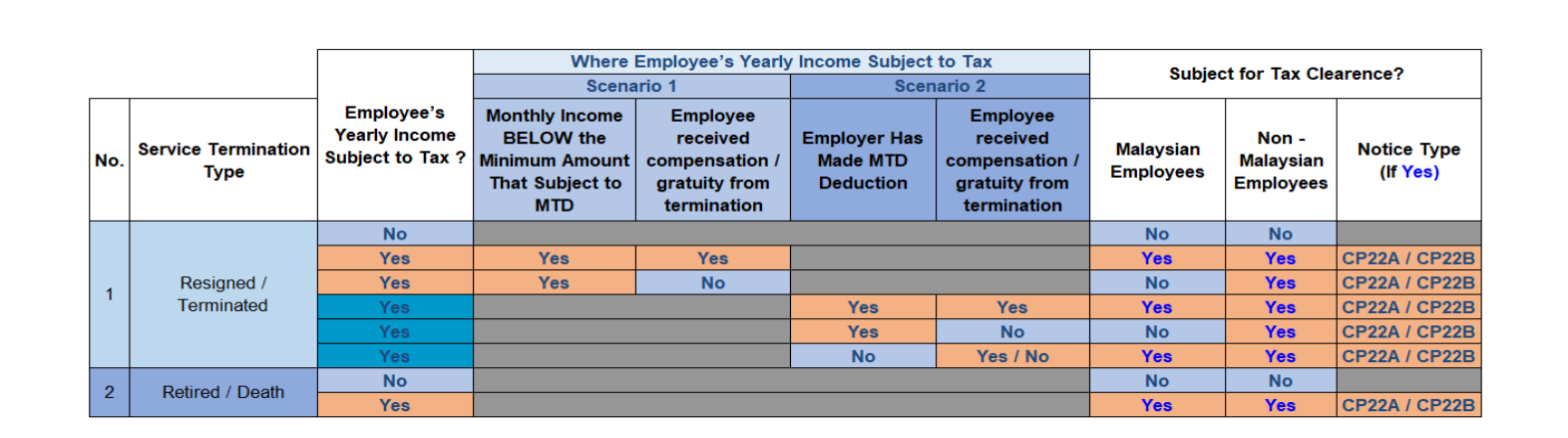

- The table below is a general guide for employers to determine whether forms CP22A / CP22B notification is required to be submitted:

-

Based on the table above, employers are required to submit Form CP22A / CP22B through e-SPC for termination cases that subject for tax clearance.

Leaving Malaysia for more than 3 months:

-

Where an employee chargeable to tax in respect of the income from an employment is about to leave or intending to leave Malaysia for a period exceeding 3 months, the employer is required to furnish Form CP21 not less than 30 days before the expected date of employee’s departure.

-

Form CP21 can be submitted either online or at the IRBM office which handles the employee’s income tax number. From 1 January 2024, Form CP22A / CP22B is mandatory to be submitted online through MyTax portal using e-SPC application.

-

However, the employer is not required to furnish such form if the IRBM is satisfied that the employee is required to leave Malaysia at frequent intervals in the course of his employment.

-

The employer is required to withhold any monies payable to an employee who is about to leave Malaysia for a period of more than 3 months with no intention of returning. The employer shall not pay any such money, except with the permission of the IRBM, to or for the benefit of the employee until 90 days after the receipt by the IRBM of the form.

-

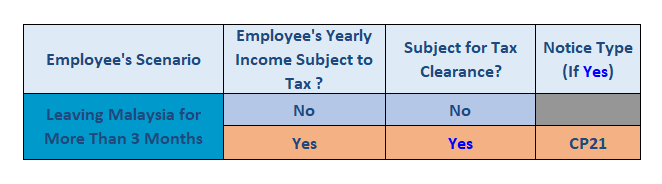

The table below is a general guide for employers to determine whether forms CP21 notification is required to be submitted:

Non-compliance by employer:

- Failure to comply with the responsibility without any reasonable excuse, upon conviction of an offence, will be liable to a fine of not less than RM200 and not more than RM20,000 or to imprisonment for a term not exceeding 6 months or to both.

- An employer shall be liable to pay the full amount of tax due from his employee. The amount due from the employer shall be a debt due to the Government and may be recovered by way of civil proceedings.

Related provisions:

- Subsections 83(3), (4) and (5) of the Income Tax Act 1967

- Subsection 106 of the Income Tax Act 1967

- Subsection 107(4) of the Income Tax Act 1967

- Subsection 120(1) of the Income Tax Act 1967