Intragroup services are services provided by one or more members of a multinational group for the benefit of the other members within the group. In general, the types of services that members of a multinational group can provide to each other include, but are not limited to, management services, administrative services, technical and support services, purchasing, marketing and distribution services and other commercial services that typically can be provided with regard to the nature of the group's business. The costs of such services, initially borne by the parent or other service companies within the multinational group, are eventually recovered from other associated persons through intragroup arrangements.

6.4 Application of arm's length principle for intragroup services

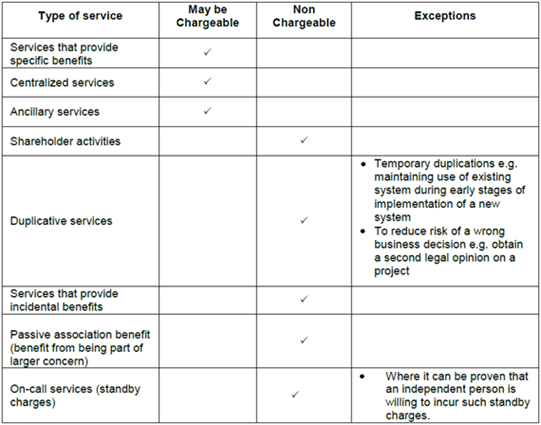

- In applying the arm`s length principle to intragroup services, taxpayers should consider:

- Whether services have been provided; and

- If so, whether the charge for these services are at arm's length prices.

- The following factors should serve as a guide in determining whether services have been provided:

- Whether the service recipient receives benefits that are of economic or commercial value; and

- Whether an independent enterprise in comparable circumstances is willing to pay for the services or perform such services in-house.

A benefit is of economic or commercial value if it -

- enhances the recipient's return or profitability by improving its production efficiencies; or

- results in cost savings or a decrease in the recipient's operating expenses for example by decreasing production time.

Charges for intragroup services must be consistent with the relative benefits intended from the services, based on the facts known at the time the services were provided, and at arm's length. Where anticipated benefits are not realized, taxpayer needs to justify that an independent party would be willing to pay for the services.

6.5 Methods of charging for provision of services

6.5.1 In charging for the provision of services, a service provider could adopt a direct charge method or an indirect charge method. The direct charge method is preferred because it facilitates the determination of whether the charge is consistent with the arm's length principal, and evidence for direct charge is usually readily available

6.5.2 Direct Charge Method

- The direct charge method is applicable for a specific service where the service, the beneficiary of the service, the cost incurred and the basis of charge can be clearly identified. Hence, the cost can be allocated directly to the recipient.

- Direct charge method must also be applied when the specific service forms part of the main business activity of the service provider, and is provided to both associated persons and independent parties.

6.5.3 Indirect Charge Method

- The indirect charge method is applicable where the direct charge method is impractical or if the arrangements for the services provided are not readily identifiable i.e. where the costs are attributable to several related enterprises and cannot be specifically assigned to the recipients of services. IRBM does not encourage the use of indirect charge method, thus the service recipients must be prepared to support their claims via indirect charge method, especially if this forms a significant amount of total claims.

Example 3

Circumstances when the indirect charge method may be applicable:

- Where sales promotion activities carried out centrally at international fairs or in global advertising campaigns benefit the group members as a whole and is reflected in increased quantity of goods produced or sold by members of the group

- The provision of information technology services like management information system which involves development, implementation and maintenance of inter-company electronic data such as transmission of marketing data, production and scheduling forecast, accounting data, etc.

- Provision of accounting services to all members of the multinational group.

- The method is based upon cost allocation and apportionment by reference to an allocation key which must be appropriate to the nature and purpose of service provided. For example, the provision of payroll services may be more related to number of staff than turnover, while the allocation of usage of networking infrastructure could be allocated according to the number of computer users.

- The arm's length principle requires that the amount allocated to a respective member of a group is in proportion to the individual member benefit or expected benefit from the services or reflects the share of the total benefits of the service attributable to that particular recipient. Taxpayers are expected to document the analysis undertaken in arriving at the choice of allocation key.

- IRBM does not accept allocation key based on sales unless the taxpayer can justify the correlation between sales and costs incurred.

6.6 Determination of arm's length charge for intragroup services

6.6.1 In applying the arm's length principle to intragroup services, it is necessary to consider from the perspective of both the provider and the recipient of the service. The service must be of value to the recipient and the price must be one that an independent party would be prepared to pay.

6.6.2 In determining arm's length prices for intragroup services the service recipient may apply external CUP together with a benefit test. For the service provider, both, the CUP and the cost plus method may be applied.

- Nature of the service;

- Value / extent of the benefit of the service to the recipient;

- The costs incurred by the service provider in providing the service;

- The functions involved in providing the service;

- The amount an independent recipient would be prepared to pay for that service in comparable circumstances. Service recipients must show benefits commensurate with the amount charged by the service provider;

- Other options realistically available to the recipients.

6.7.1 It is vital to consider whether mark-up on a cost base is justifiable since in an uncontrolled transaction an independent person would normally seek to earn a profit from providing services, rather than merely charging them out at cost. Therefore, it is necessary to understand the nature of activity, the significance of the activity to the group, the relative efficiency of the service supplier and any advantage that the activity creates for the group

6.7.2 The nature of service and the expected value to a recipient influence the arm's length price of the service provider. Specialized services, such as engineering services in the oil and gas industry, warrant a higher mark-up than general services such as repair and maintenance.

6.7.3 When applying the cost-plus method to an associated enterprise which assumes the role of an agent or intermediary to obtain services from independent enterprises on behalf of its group members, it must be ensured that the arm's length return is limited to rewarding the agency/intermediary function only. It is not appropriate to charge a service fee based on mark-up on cost of the services obtained from independent enterprises.

6.7.4 If a tested party is the service recipient in Malaysia, a mark-up by an overseas affiliate service provider which has fulfilled an arm's length test in that service provider's country of residence need not automatically be deemed arm's length in Malaysia. A benefit test from the perspective of the service recipient must still be demonstrated.