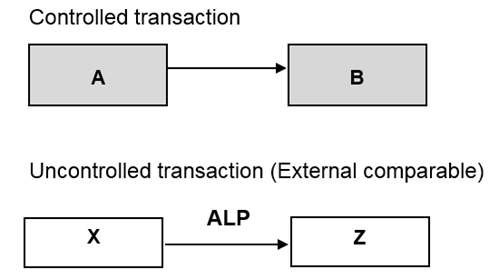

A MNE using the CUP method to determine its transfer price must first identify all the differences between its product and that of an independent person. The MNE must then determine whether these differences have a material effect on the price, and adjust the price of products sold by the independent person to reflect these differences to arrive at an arm's length price.

A comparability analysis under the CUP method should consider amongst others the following:

- Product characteristics such as physical features and quality.

- If the product is in the form of services, the nature and extent of such services provided.

- Whether the goods sold are compared at the same points in the production chain.

- Product differentiation in the form of patented features such as trademarks, design, etc.

- Volume of sales if it has an effect on price.

- Timing of sale if it is affected by seasonal fluctuations or other changes in market conditions.

- Whether costs of transport, packaging, marketing, advertising, and warranty are included in the deal.

- Whether the products are sold in places where the economic conditions are the same.