Transfer pricing generally refers to intercompany pricing arrangements for the transfer of goods, services and intangibles between associated persons. Ideally, the transfer price should not differ from the prevailing market price which would be reflected in a transaction between independent persons. However, business transactions between associated persons may not always reflect the dynamics of market forces. These Transfer Pricing Guidelines (hereinafter referred to as the Guidelines) are largely based on the governing standard for transfer pricing which is the arm`s length principle as set out under the Organization for Economic Co-operation and Development (OECD) Transfer Pricing Guidelines. Although some parts of the Guidelines have been adopted directly from the OECD Transfer Pricing Guidelines, there may be areas which differ to ensure adherence to the Income Tax Act 1967 (the Act) and Inland Revenue Board of Malaysia (IRBM) procedures as well as domestic circumstances. In this regard, the Guidelines may be reviewed from time to time. Notwithstanding the aforementioned, the arm's length principle remains as the guiding principle throughout the Guidelines. Examples shown in the Guidelines are for illustrative purposes only. Thus, in dealing with actual cases, the facts and circumstances of each case must be examined before deciding on the applicability of any of the methods described in the Guidelines

1.2.1 The purpose of the Transfer Pricing Guidelines is to replace the IRBM Transfer Pricing Guidelines issued on 2 July 2003, in line with the introduction of transfer pricing legislation in 2009 under section 140A of the Act, and the Income Tax (Transfer Pricing) Rules 2012 (hereinafter referred to as the Rules).

1.2.2 The Guidelines are concerned with the application of the law on controlled transactions. They provide guidance for persons involved in transfer pricing arrangements to operate in accordance with the methods and manner as provided in the Rules, as well as comply with administrative requirements of the IRBM on the types of records and documentations to maintain.

1.3.1 The Guidelines are applicable on controlled transactions for the acquisition or supply of property or services between associated persons, where at least one person is assessable or chargeable to tax in Malaysia. To ease compliance burden persons referred to do not include individuals not carrying on a business, further-

- for a person carrying on a business, the Guidelines apply wholly to a business with gross income exceeding RM25 million, and the total amount of related party transactions exceeding RM15 million.

- where a person provides financial assistance, the guidelines on financial assistance are only applicable if that financial assistance exceeds RM50 million. The Guidelines do not apply to transactions involving financial institutions.

1.3.2 Any person which falls outside the scope of 1.3.1 may opt to fully apply all relevant guidance as well as fulfil all Transfer Pricing Documentation requirements in the Guidelines; or alternatively may opt to comply with Transfer Pricing Documentation requirements under paragraph 11.2.4 (a), (c) and (d) . In this regard, the person is allowed to apply any method other than the five methods described in the Guidelines provided it results in, or best approximates, arm's length outcomes.

1.3.3 Notwithstanding the aforementioned paragraphs the Guidelines need not apply to transactions between persons who are both assessable and chargeable to tax in Malaysia and where it can be proven that any adjustments made under the Guidelines will not alter the total tax payable or suffered by both persons. Please also refer to paragraph 11.2.2.

1.3.4 The Guidelines are also applicable by analogy, in relation to transactions between a permanent establishment (PE) and its head office or other related branches. For the purpose of the Guidelines, the PE will be treated as a (hypothetically) distinct and separate enterprise from its head office or other related branches. Paragraph 1.3.1 does not apply to this category of taxpayers.

1.4.1 Section 140 of the Income Tax Act 1967 (ITA) empowers the Director General of Inland Revenue (DGIR) to disregard certain transactions which are believed to have the direct or indirect effect of altering the incidence of tax, and make adjustments as he thinks fit, to counter-act the effects of such transactions. Thus, Section 140 allows the DGIR to disregard transactions believed not to be at arm's length and make the necessary adjustments to revise or impose tax liability on the persons concerned. Under subsection 140(6), the said non arm's length dealings include transactions between persons one of whom has control over the other and between persons both of whom are controlled by some other person

1.4.2 With effect from 1.1.2009, section 140A was introduced to specifically address transfer pricing issues. The section requires taxpayers to determine and apply the arm's length price on controlled transactions. This section further allows the DGIR to make an adjustment to reflect the arm's length price, or interest rate, for that transaction by substituting or imputing the price or interest, as the case may be; and to disallow considerations for controlled financial assistance which are deemed excessive in respect of a person's fixed capital.

1.4.3 Paragraph 154(1)(ed), also introduced with effect 1.1.2009, empowers the Minister of Finance to provide for the scope and procedure relating to the implementation and facilitation of section 140A by way of the Income Tax (Transfer Pricing) Rules 2012.

1.5 Meaning Of Control And Associated

1.5.1 Section 139 of the ITA refers to "control" as both direct and indirect control. The interpretation of related companies or companies in the same group (referred to in the context of holding and subsidiary companies) is provided for under subsection 2(4) of the same Act.

1.5.2 Under the Guidelines, two companies are associated companies with respect to each other if one of the companies participates directly or indirectly in the management, control or capital of the other company; or the same persons participate directly or indirectly in the management, control or capital of both companies.

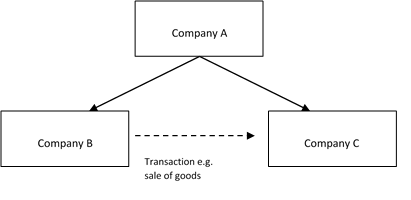

Examples of control and associated persons:

In this example, Company A controls Company B and Company C through share ownership. As Company A controls both Company B and Company C, Companies B and C are associated enterprises. Therefore, transfer pricing laws apply to transactions between the two.

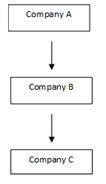

Example 2

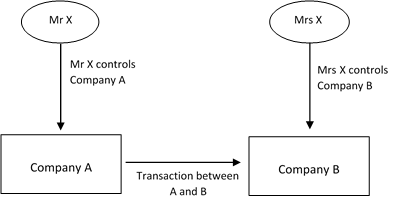

Example 3

The Act provides that transactions between Company A and Company B are deemed controlled transactions due to the relationship between Mr X and Mrs X.